proposed estate tax changes october 2021

The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

Check Out This Item In My Etsy Shop Https Www Etsy Com Listing 1077768520 Printable New Car Savings Tracke Car Saving Savings Tracker Money Saving Strategies

While there is still a lot of uncertainty at this point we do know that big changes are on the horizon.

. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person.

31 2021 the Act would reduce the estate and gift tax exemptions from their present high level and increase the top tax rates as follows. The package proposed reducing the current 117 million estategift tax exemption by 50 percent. Establishing a user fee for estate tax closing letters proposed regulations were published on Dec.

July 13 2021. Would eliminate the temporary increase in exemptions. PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021.

Pillar One would address digitalization and allow countries to tax very large multinational companies that do not have a physical presence in the taxing jurisdiction. No Changes to the Current Gift and Estate Exemption Provisions Until 2025. Gift Tax Exemption reduced to 1 million.

The Biden Administration has proposed significant changes to the income tax system. Federal Estate Tax Rate. The introduction of a 3 additional tax on high income individuals 5 million if married filing jointly and trusts and estates with income above 100000.

Other changes are set to be effective for transactions occurring on or after September 13 2021 including a 25 capital gains rate and having the sales of Section 1202 company stock also known. Reduction in Federal Estate and Gift Tax Exemption Amounts. The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals published.

Enacted in the Tax Cuts and Jobs Act TCJA. Revise the estate and gift tax and treatment of trusts. Proposed Estate Tax Exemption Changes The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of the Lifetime Exemption.

The exemption will increase with inflation to approximately 12060000 per person in 2022. Recent Changes in the Estate and Gift Tax Provisions Congressional Research Service proposal currently considered as part of reconciliation would return the exemption levels to 5 million indexed for inflation which would be approximately 59 million in 2021 allow. That amount is annually adjusted for inflationfor 2021 its 117 million.

Friday October 29 2021. On October 8 2021 the OECDG20 member states agreed in principle to two pillars to reform international taxation rules. Estate gift and GST tax exemptions will remain at 117 million with increases allowed for inflation in 2022-2025.

The increase of the top marginal income tax rate from 37 to 396. 2021 was an interesting year for estate planning. Current 117 million gift and estate tax exemption could be reduced to approximately 603 million after December 31 2021.

Spousal Limited Access Trusts SLATs became a household word and will continue to be very popular See Forbes Blog Estate Tax Law Changes What To Do Now September 14 2021. For gifts and estates occurring after Dec. Under the Plan the current Lifetime Exemption will be reduced to 5000000 per person or 10000000 for married couples and adjusted for inflation to 6000000 per.

For nearly a year various proposals and so-called frameworks have been debated in Congress regarding. Tax Changes for Estates and Trusts in the Build Back Better. The Wealth Advisor Contributor.

The TCJA doubled the gift and estate tax exemption to 10 million through 2025. In enormous changes for estate tax planning. The bill rolls back the current estate tax and gift tax exemptions from the current 117 million to an inflation-adjusted 585 million and.

Reductions to Exemptions and Increases to Tax Rates. The BBBA would return the exemption to its pre-TCJA limit of 5 million in 2022. Grantor trusts trusts whose taxable activity and income are reported on the income tax returns of the persons who created the trusts have been a target of proposed legislation this year.

As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax. Act BBBA The Build Back Better Act BBBA. Under the current proposal the estate tax remains at a flat rate of 40.

Key proposals in the estate planning realm that have been. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted. Lower Gift and Estate Exemptions.

31 2020 and for the following Internal Revenue Code sections. The Bill includes several other changes that if enacted could affect existing estate plans. The current 2021 gift and estate tax exemption is 117 million for each US.

The current 2021 gift and estate tax exemption is 117 million for each US. Tax Law Update. Bidens Tax Proposals And Estate Planning.

Pin On Thai Lottery Tips Results

Things You Should Know Before Filing The Monthly Gst Returns The Deadline For Filing Annual Retur Goods And Services Goods And Service Tax Fiscal Year

2019 Usps Rate Summary For Priority Mail And First Class Mail Usps Shipping Rates Usps Priorities

How To Trade Long Tailed Pin Bar Signals On Daily Charts Trading Trading Strategies Forex Trading Strategies

Free Printable Savings Tracker Savings Tracker Money Saving Plan Family Money Saving

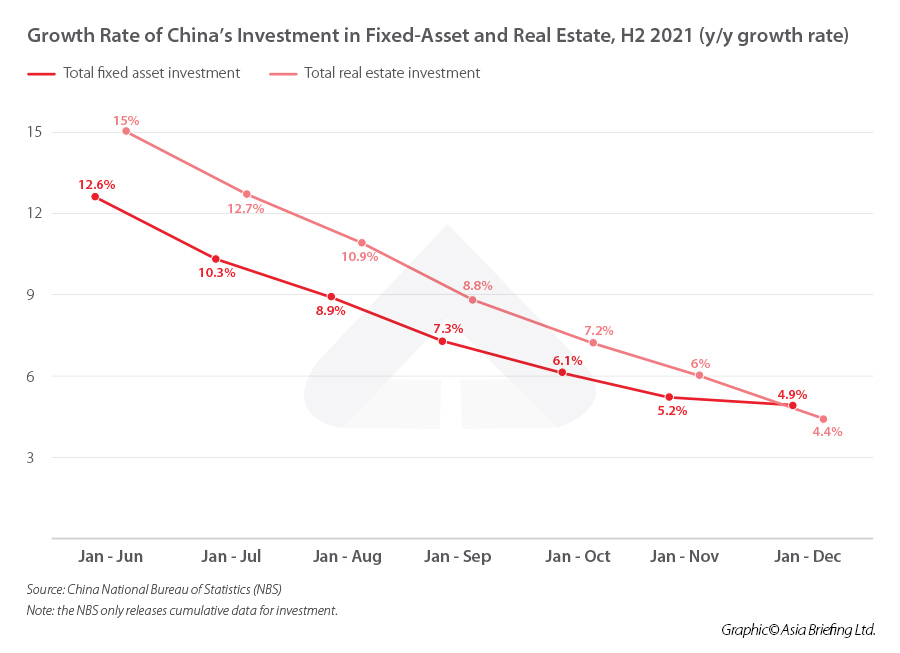

Assessing China S 2022 Economic Outlook Based On 2021 Data Points

How To Profit From Dividends On Etoro Daily Using Dividend Calendar And Leverage Steemit Dividend Finances Money Dividend Stocks

Assessing China S 2022 Economic Outlook Based On 2021 Data Points

Fifteen 52 Week Money Saving Challenges Something For Every Budget 52 Week Money Saving Challenge Saving Money Chart Money Saving Challenge

The Federal Pie Chart Military Spending Pie Chart Budgeting

Pin On Work From Home Jobs Start A Homebased Business

Generate Leads Lead Generation Generation Entertaining

Pinned October 15th 25 Off Paints Stains At Sherwinwilliams 10 31 Coupon Via The Coupons Sherwin Williams Coupon Print Coupons Free Printable Coupons

Valvoline 19 99 Oil Change Coupon Oil Change Oils Change

These Countries Offer The Highest Interest Rates Today Interest Rates Loan Interest Rates Country